Over the past 7 years, I’ve collected 24 credit cards. Not because I wanted to chase every sign-up bonus or flaunt a wallet full of plastic, but because I’ve always had a deep interest in finance and tech. Most of the cards I have were offered to me were LTF & pre-approved.

Each card gave me a chance to explore something new:

➡️ reward structures,

➡️ credit networks,

➡️ bill cycles,

➡️ CIBIL impact,

➡️ and evolving systems like RuPay Credit on UPI.

But here’s the question I get asked most:

“How do you manage so many cards without missing a single payment?”

💡 The Secret? BBPS + Autopay = Zero-Stress Credit Life

The key to managing multiple credit cards — whether 3 or 30 — is having a single dashboard to track and pay all your bills. And in India, BBPS (Bharat Bill Payment System) is the answer.

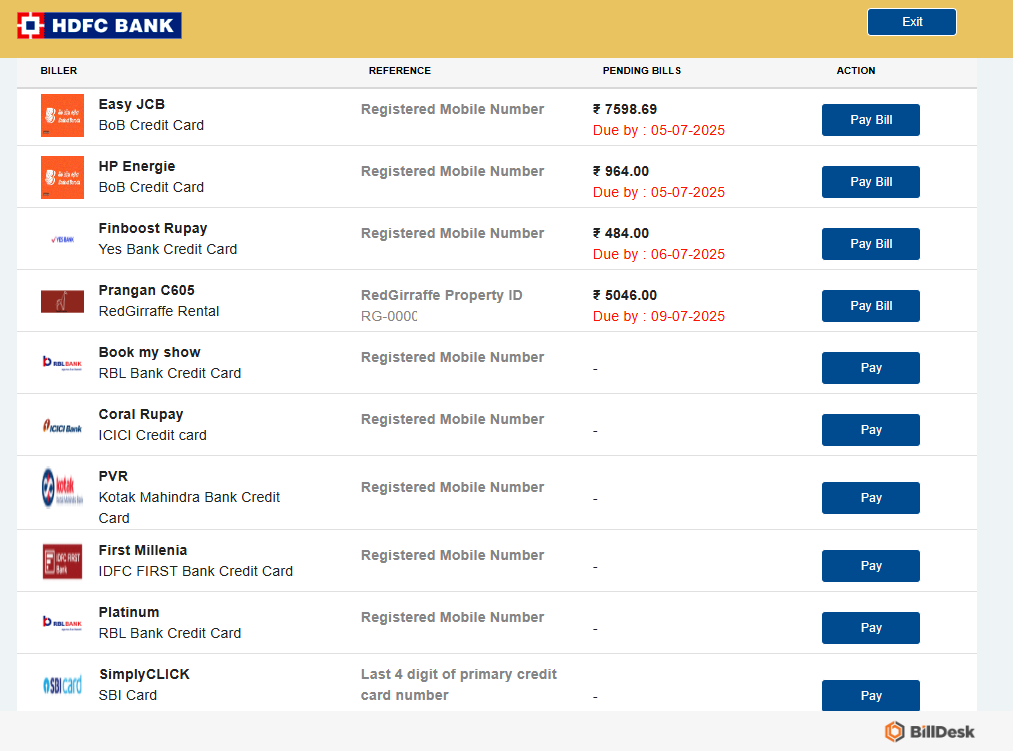

I use BBPS through HDFC NetBanking, and it has changed the game. BBPS is available for use on most internet banking platforms, and it’s simple, working similarly across all internet banking systems.

Here’s how my setup works:

🔧 My BBPS Setup in HDFC NetBanking

✅ Added all credit cards (from different banks) under the BBPS section, except for ONECARD (FEDERAL), as it is not yet supported. Still, you can set up autopay for it separately, and HDFC’s cards can be done via its internet banking dashboard.

✅ Enabled AutoPay for each card, with payment set for 4 days before the due date

✅ Got email + SMS confirmation every time a bill is generated, and once the bill is paid.

✅ Can view all upcoming credit card bills in one dashboard — no surprises

✅ So the key is setting up the autopay for each card to avoid the human error of missing payments

The beauty?

It doesn’t matter if the card is from SBI, Axis, ICICI, Kotak, YES Bank, BOB, RBL, or IndusInd — it works for all.

🧾 The Cards I Actually Use — Out of 24

While I’ve passively collected cards over the years (often just by accepting pre-approved offers), I do not have any super premium card because they come with an annual fee or a spend target, after which the fee gets waived hence I actively use only those that provide real daily value as per my spend pattern and minimal annual fee:

- ICICI Amazon Pay – For all my Amazon + utility spends

- OneCard – Clean app + versatile usage

- Axis IOCL Premium – My fuel essential

- SBI BPCL – Backup fuel card

- IDFC Millennia – Just for railway lounge access

- RBL BookMyShow – Free movie tickets

- Kotak PVR Business Gold – Additional movie benefits

- All Rupay Cards: I use to pay for my small-value transactions

These cards offer decent cashback, useful perks, and genuine savings — all without hefty annual fees — while helping me maintain a strong CIBIL score.

I use my other credit cards occasionally when a merchant or platform offers a bank-specific discount or cashback offer. In those cases, I simply use the relevant card to take advantage of the deal.

💳 My Spending Strategy — RuPay UPI All the Way

I rarely use my debit card or direct bank account for transactions now.

Instead, I now primarily use RuPay credit cards linked with UPI for most of my daily small-value transactions — whether it’s groceries, dining, or retail, making my spending both decently rewarding and seamless.

Why?

- I earn rewards on UPI spends

- It helps maintain my credit activity, improving my CIBIL score

- It keeps my bank account untouched and statements clean, free from clutter caused by small UPI payments

- It’s widely accepted now — groceries, restaurants, petrol, everywhere!

Unless a merchant doesn’t accept credit on UPI, I’m swiping (well, scanning!) via RuPay.

📈 Benefits of This System

- ₹30,000+ in yearly benefits (fuel, cashback, lounge, movies)

- One platform for all credit card bills (via BBPS)

- No late fees — ever

- On-time payments = excellent credit score

- Mental clarity and control over money

❗ Common Problem: Why Most People Miss Credit Card Payments

Most people still rely on:

🚫 Email reminders that go to spam

🚫 SMS alerts that get missed

🚫 Individual app notifications for each card

This scattered system leads to missed payments, late fees, and CIBIL hits.

That’s why a centralized BBPS setup is not just convenient — it’s essential.

🧭 Final Words: You Don’t Need 24 Cards. You Need 1 Dashboard.

Even if you have 2–3 credit cards, setting up BBPS + AutoPay will:

- Make your life easier

- Help you avoid human error

- Protect your CIBIL score

- Automate your financial hygiene

📩 Want Help Setting This Up?

If you’re overwhelmed or confused about managing your cards, I can help.

Leave a Reply